AUD/USD

Yesterday, on the AUD/USD daily chart it was created a nice bullish reversal PIN bar, which is admittedly against the long-term downtrend, but formed at a very important support. Price could after this PIN bar rise at least to the short term resistance 0.8030. I personally take this as a buy signal and will trade him.

Bullish reversal PIN bar on the daily chart AUD/USD

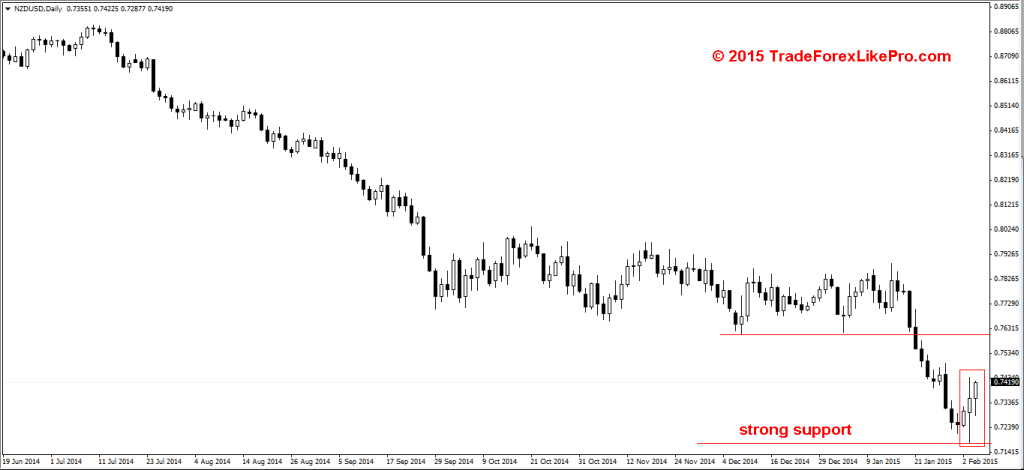

NZD/USD

A similar situation developed on kiwi (daily chart NZD/USD), which is with the AUD/USD in mutual correlation.

NZD/USD daily chart

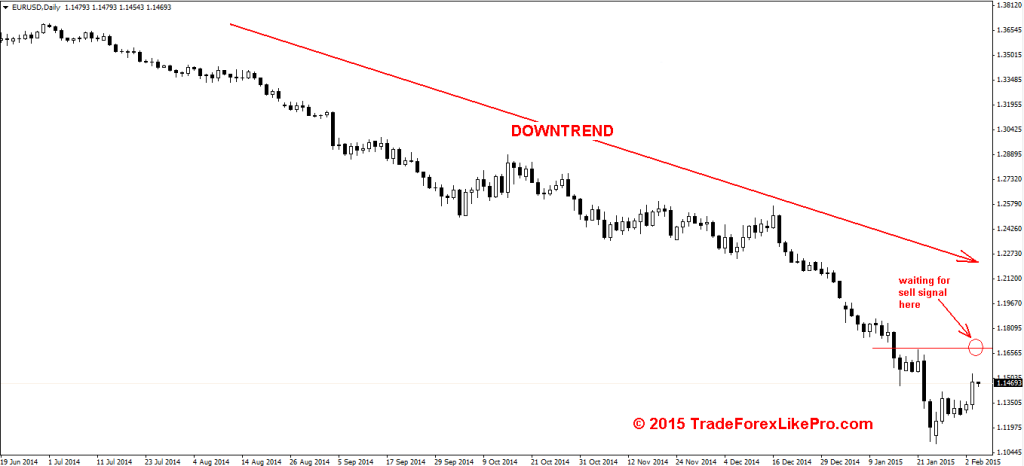

EUR/USD

In yesterday’s commentary I wrote that the price of the current chop will set off in one direction. Yesterday created a breakout and the price surged upwards. I had set a pending order to sell, if there would be a break down so the command was not activated. Eurodollar is still in a strong downtrend so now I’ll wait for the signal to sell somewhere around 1.1680.

Daily chart EUR/USD

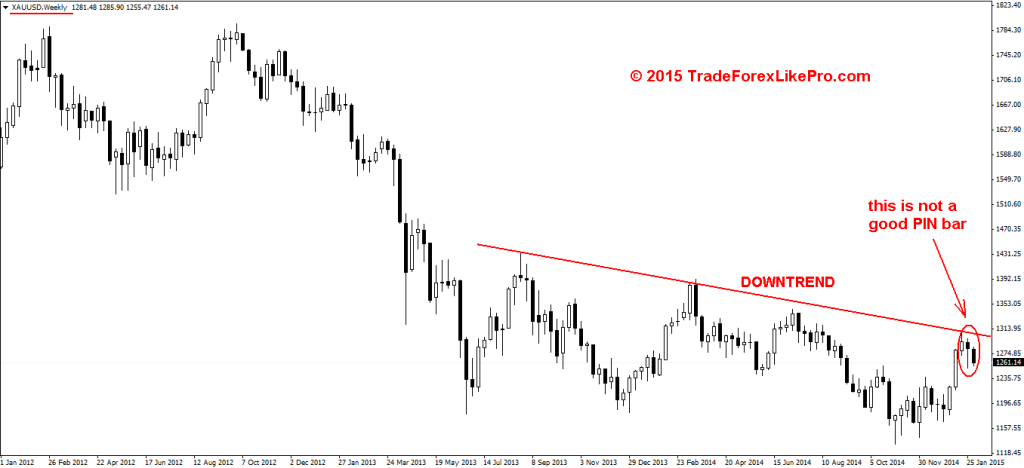

XAU/USD – gold

A few days ago one of the readers of this blog Thomas wrote me that on the weekly chart XAU has created a nice pin bar in the direction of the uptrend – what is my opinion.

Gold – Weekly chart

First, I must say that this PIN bar is not in the direction of an uptrend. When you look at the weekly chart, gold is in a long-term downtrend. In addition, it was created at the top (high prices), so this is not a good PIN. If his body was upside down, it could be considered as a good signal, but signal to sell.

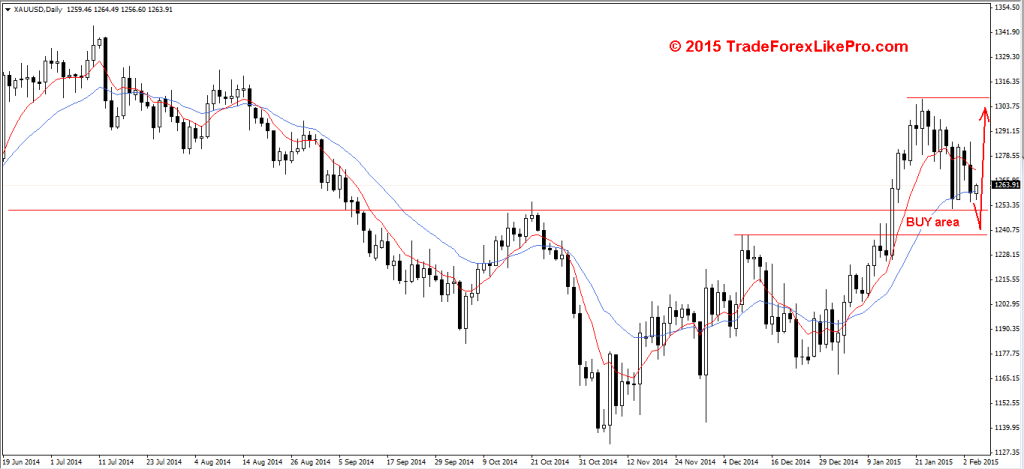

On the daily chart, the situation is a little different – here you could consider long:

Gold – Daily chart

We’ll see how the price will behave further. If somewhere between 1238.00 to 1250.00 will create a nice price action signal to buy, I would consider a long position. Target somewhere around 1300.00.

Comments

comments

Forex commentary – 5th February 2015

AUD/USD

Yesterday, on the AUD/USD daily chart it was created a nice bullish reversal PIN bar, which is admittedly against the long-term downtrend, but formed at a very important support. Price could after this PIN bar rise at least to the short term resistance 0.8030. I personally take this as a buy signal and will trade him.

Bullish reversal PIN bar on the daily chart AUD/USD

NZD/USD

A similar situation developed on kiwi (daily chart NZD/USD), which is with the AUD/USD in mutual correlation.

NZD/USD daily chart

EUR/USD

In yesterday’s commentary I wrote that the price of the current chop will set off in one direction. Yesterday created a breakout and the price surged upwards. I had set a pending order to sell, if there would be a break down so the command was not activated. Eurodollar is still in a strong downtrend so now I’ll wait for the signal to sell somewhere around 1.1680.

Daily chart EUR/USD

XAU/USD – gold

A few days ago one of the readers of this blog Thomas wrote me that on the weekly chart XAU has created a nice pin bar in the direction of the uptrend – what is my opinion.

Gold – Weekly chart

First, I must say that this PIN bar is not in the direction of an uptrend. When you look at the weekly chart, gold is in a long-term downtrend. In addition, it was created at the top (high prices), so this is not a good PIN. If his body was upside down, it could be considered as a good signal, but signal to sell.

On the daily chart, the situation is a little different – here you could consider long:

Gold – Daily chart

We’ll see how the price will behave further. If somewhere between 1238.00 to 1250.00 will create a nice price action signal to buy, I would consider a long position. Target somewhere around 1300.00.

Comments